The real estate market has softened considerably over the last year as a result of the end of the pandemic-era housing boom, rapid increase in mortgage rates, and economic uncertainty. Throughout the latter half of 2022 and first half of 2023, many markets recorded double digit decreases in year-over-year closings signaling a new normal for the housing market. Despite the softening, for a long time prices remained elevated, buoyed by extremely low inventory. Today, we’re a little over a year out since the housing market began its slowdown. Sales are still lower than a year ago, but the differential is much smaller. We are starting to see prices contract slightly; however, the recent dip has not been evenly distributed across the housing market.

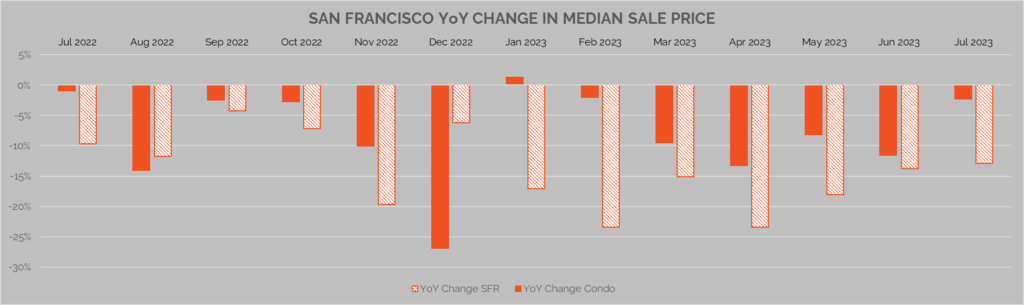

The condominium market has been much more resilient than the single-family home market. In San Francisco, for example, the year-over- year change in median sale price for condominiums is -2% whereas for the single-family home market it’s -13%. Looking further south in the

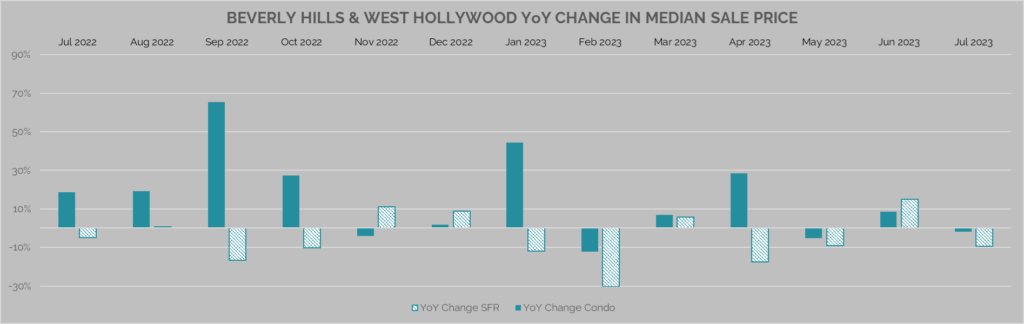

Beverly Hills/West Hollywood market the same trend is observed. The year-over-year change in single-family home median prices is -9% versus -2% for condominiums. Why are the two markets faring so differently?

Much of the explanation for the recent resiliency of the condominium market relative to the single-family home market can be attributed to the dynamics of the most recent housing boom between mid-2020 and early 2022. In addition to an environment of super low interest rates, the recent housing boom was in large part driven by pandemic induced changes in buying patterns. The Covid lockdowns brought about a heightened need for space, driving demand for single-family homes to record highs. Buyers across the county faced competitive bidding wars and purchase terms for single-family homes. At the same time, the condominium market’s performance was largely muted as the same demand drivers for homes became drawbacks of condo living.

Today, the pandemic-era drivers of demand have largely subsided. This in turn, coupled with other economic factors and mortgage rate conditions, has resulted in less frenzied demand for single-family homes and a return to the once shunned condo market. Furthermore, higher interest rates have had a severe cooling effect on the move-up market impacting single-family prices. As a result, single-family homes are seeing a greater degree of price contractions than condominiums.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.