In last month’s Spotlight report, The Kennelly Group analyzed the relationship between the federal funds rate and 30-year fixed-rate mortgages. We looked at historical trends dating back to 2000 and found that the Federal Reserve has little impact on fixed-rate mortgages via its benchmark interest rate. It is a common misconception that the two move hand-in-hand. Instead, fixed-rate mortgages are tied to the bond market, particularly long-term Treasury yields.

In this month’s Spotlight, we focus on another home loan product: adjustable-rate mortgages (ARMs), which have been back in the press recently. Despite getting a bad reputation during the financial crisis and subsequent housing crash, adjustable-rate mortgages now offer many more protections than in the early aughts. And while there are a multitude of ARM products, this report focuses on the popular 5/1 hybrid adjustable-rate mortgage. Whereas fixed-rate mortgages lock in a set interest rate for a fixed number of years—say 30—a 5/1 ARM is characterized by an initial fixed interest rate period (5 in this case), followed by a rate that adjusts on an annual basis (the 1).

Over the last few years ARMs hadn’t been in demand due to the record low interest rate environment; however, that has changed in recent months. With fixed-rate mortgages on the rise this year, many buyers are feeling squeezed as low mortgage rates are no longer offsetting home price appreciation. With homes more costly than ever, many buyers are looking toward ARMs which typically start at a lower level then prevailing rates on 30-year fixed-rate mortgages.

To understand how the federal funds rate affects ARMs, it is important to understand the two components that makeup the interest rate on an ARM: the index and the margin. The index is a benchmark rate used as a reference to determine the base rate for an ARM; the margin represents a level of interest (typically 2-3%, though it varies by lender) that’s added to the index rate to form the fully indexed interest rate that the borrower is expected to pay.

While the margin is set by lenders, the index is subject to fluctuations in the benchmark rate to which it is pegged. Some of the most common ARM indexes include the rates on 1-year constant-maturity Treasury securities and the London Interbank Offered Rate (LIBOR) which is currently being phased out and replaced by the Secured Overnight Financing Rate (SOFR).

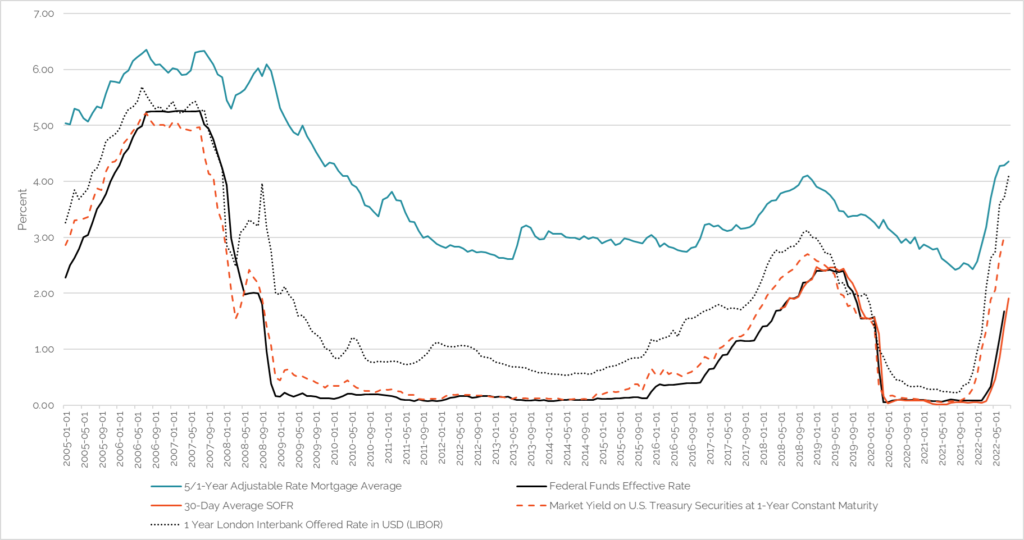

While each of these has unique characteristics and measurements, they are related in the sense that they are all tied or heavily influenced by the federal funds rate such that the Fed’s decision to increase or decrease the federal funds rate can cause these rates to go up or down. The chart on the previous page illustrates the historical relationship between 5/1 ARMs, the federal funds rate, and three of the most common benchmark indexes.

As evidenced, there is a direct relationship between the federal funds rate and the other rates tracked, though there have been some historical divergences, particularly with LIBOR, that are outside the scope of this report. Furthermore, the average 5/1 ARM rate displays co-movement with the rates it is commonly pegged to. It is important to note; however, that adjustable-rate mortgage products are complex and varied both with respect to how the rate is calculated (the index + margin) as well as the initial interest rate period and any interest rate cap structure. Nevertheless, home buyers interested in this alternative home loan to the conventional fixed-rate mortgage should follow the Fed’s decisions closely as well as understand which of the indexes their specific loan is tied to.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.