In this month’s Spotlight report, The Kennelly Group continued to focus on mortgage rates, this time looking at the relationship between mortgage rates and the housing market. Following the initial shock of the pandemic in the Spring of 2020, the housing market boomed. Home prices soared to new heights with bidding wars becoming commonplace in markets across the country. Strong demand coupled with a housing supply shortage drove much of the rapid price appreciation. Despite sky-high prices, home sales continued to remain strong over much of the last two years; albeit inventory challenges did subdue the pace in many markets. Homebuyers were in large part able to keep up with price appreciation because of record low interest rates which came about during the Covid pandemic. By December 2020, nine months into the pandemic, the 30-year fixed mortgage rate reached a historical low of 2.7%. It then ranged between 2.7% and 3.1% the following year. 2022 saw a major shift with mortgage rates soaring from 3.2% at the start to a current weekly average of 6.9%, their highest level since 2008. Adjustable- rate mortgages also rose substantially with the average 5/1 ARM rate up from 2.4% at the start of the year to 4.9%.

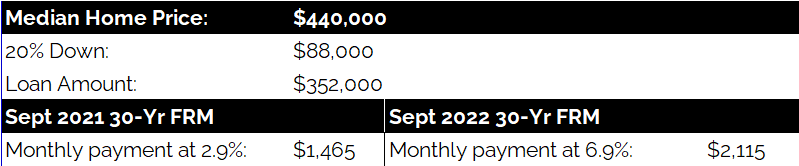

Focusing on just the 30-year fixed rate, the most common mortgage in the marketplace, the table below summarizes the change in monthly payments for a typical home in the US:

In just one year, a prospective buyer for a typical home would have to pay 44% more in monthly payments versus a year ago. A buyer looking at adjustable-rate mortgages would also see their monthly payments up from a year ago; however, the factors dictating the monthly rate are more complex and therefore not covered in detail in this report.

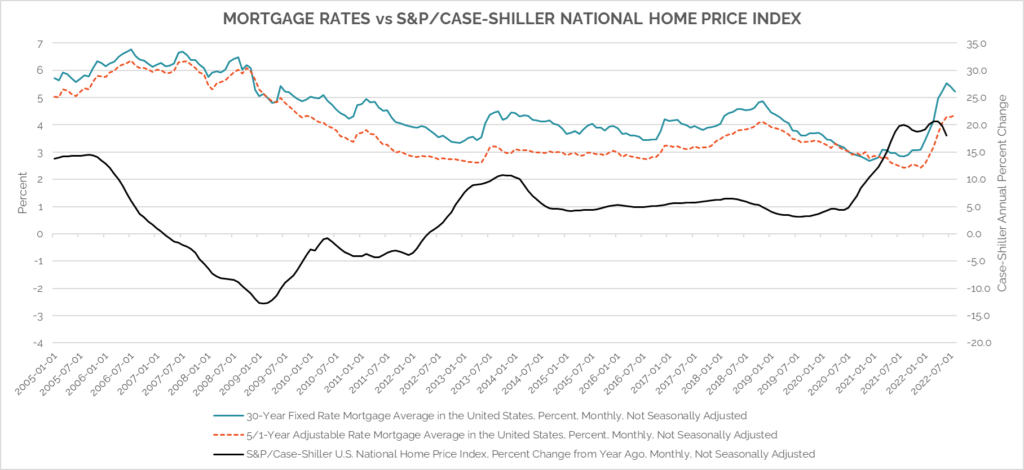

To see whether and to what extent mortgage rates are affecting the housing market, we looked at the historical movement of the 30-year fixed-rate mortgage, the 5/1 adjustable-rate mortgage, and the year over year change in the S&P/Case Shiller US National Home Price Index. The latter is an indexed measure of single-family home prices in the US. It is calculated monthly, using a three-month moving average and published with a two-month lag.

The historical movement suggests a weak, albeit positive relationship. It’s important to note that the most recent index is for June 2022, whose average includes home prices from the previous three months. Nevertheless, the trend shows that while quickly rising interest rates tend to slow home price appreciation (seen in the latest month’s data), mortgage rates and home prices do not move one-to-one. Although mortgage rate applications have decreased since the start of the year, and many markets are seeing fewer bidding wars, the market is still strong by historical standards such that tight supply and strong demand appear to be outweighing the effects of rising mortgage rates.

What this means for the housing market is that higher prices will likely be sustained for a bit longer, as they have been for much of this year, temporarily pricing out some buyers in the market; however, eventually the market is expected to adjust to the higher rate environment and much of the frenzy seen over the last 2 years will normalize. In next month’s Spotlight, we will continue to cover the impact of rising mortgage rates on the housing market with focus on how interest rates affect home sales.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.