In October 2022, the average 30-year fixed rate mortgage (FRM) hit 7%, the highest level since 2001. Over the last ten months, the Federal Reserve has been raising interest rates to combat inflation. While the federal funds rate and mortgage rates are not directly tied, as discussed in our August 2022 Spotlight, mortgage rates anticipate future moves by the Fed and bond markets. At the start of the year, the 30-year FRM stood at 3.5%, half of where it is some ten months later.

In last month’s Spotlight, we looked at to what extent rising mortgage rates affect home prices. We analyzed historical mortgage rate data as well as the Case-Schiller National Home Price Index and concluded that price growth would decelerate; however higher prices would likely be sustained in the short term—buoyed by demographic tailwinds and limited inventory. In the medium to long-term, prices are expected to adjust as the market normalizes.

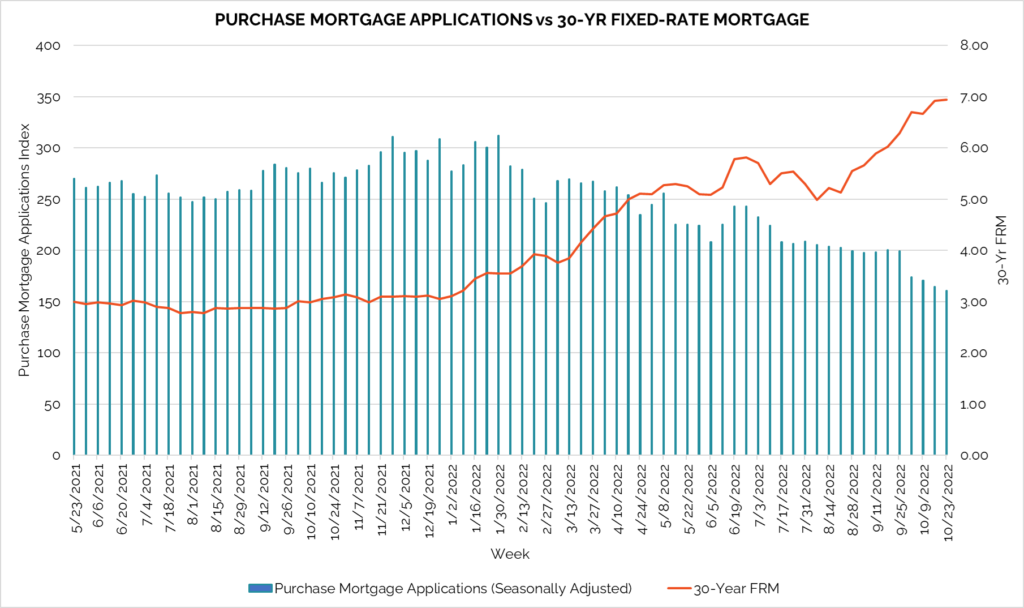

With respect to home sales, we are beginning to see higher borrowing costs weigh on closings; however, the outlook isn’t all bleak. A review of purchase mortgage applications and the 30-year FRM suggests that while demand is down, it hasn’t bottomed out. Purchase mortgage applications are a weekly measure of nationwide home loan applications based on a sample of about 75% of US mortgage activity. While the index does not measure the number of homes purchased or mortgage loans closed, simply applications, it is considered a four-to-six-week leading indicator of the housing market.

By all respects, we are hardly seeing a weak housing market; in many cities homes continue to sell as quickly as ever. Home sales are in many ways resilient to rising mortgage rates which, in normal times, are just one, albeit important, factor that goes into the decision to purchase. We are instead seeing a winding down of the pandemic housing boom and a return to more balanced conditions.

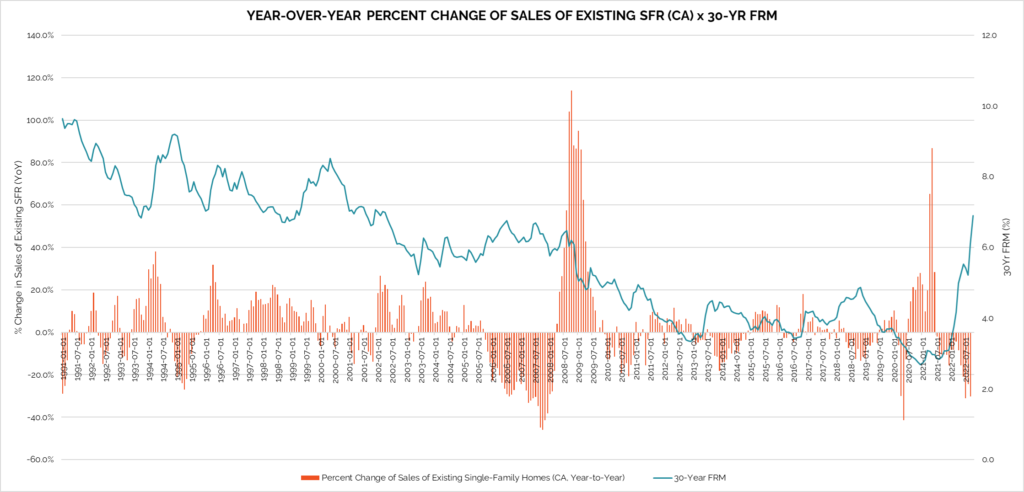

This trend is also evident when looking at a different set of metrics: the year-over-year percent change of existing single-family homes and the 30-year fixed-rate mortgage. The chart below shows the two metrics over the last thirty years. While there are instances where existing single-family home sales changed substantially from the previous year as rates rose or fell—namely the later half of 1994 through 1995, mid-2013 through 2014, and again during the Covid-19 pandemic—the two don’t display a strong correlation. Instead, while it is clear that higher mortgage rates, particularly when they increase rapidly, do weigh on home sales there are many other factors that determine the health and performance of the housing market including broader economic conditions, demographic trends, and supply.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.