The housing market from mid-2020 through early 2022 was characterized by tight supply, bidding wars, and rapid price appreciation. Many buyers, as a result of lifestyle changes and record low mortgage rates, crowded into the housing market. Borrowers locked in extremely favorable (~3% fixed-rate mortgages)—both for initial purchases or for refinances. Fast forward to the present, and many of these would-be move-up buyers—that is buyers looking to trade up for bigger, more expensive properties—are now reluctant to sell and give up their low-rate mortgages.

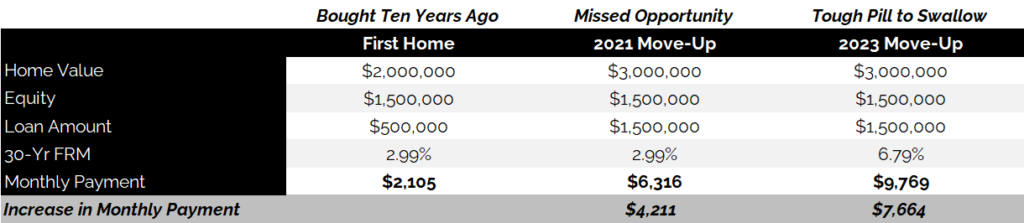

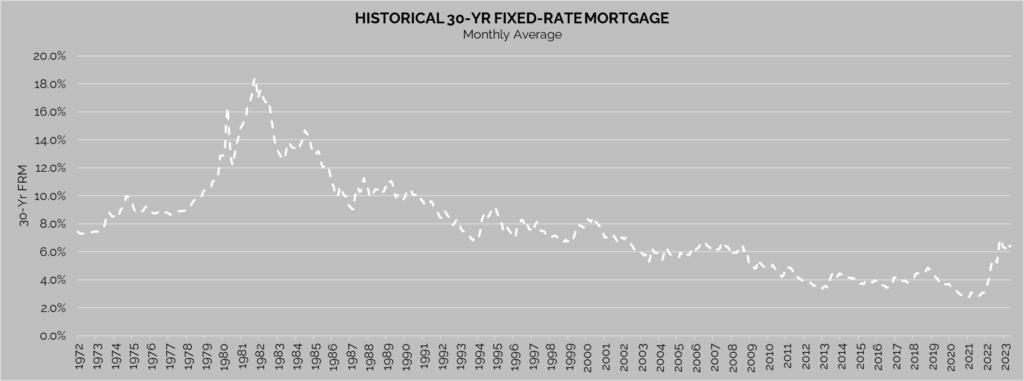

Today, the average weekly mortgage rate for a 30-year fixed rate loan stands at 6.79% compared to 2.99% two years ago. To see the effects of these ‘golden handcuffs’, consider the following example of a homebuyer looking move-up from a $2 million home to a $3 million home.

Outlined below is a typical example—at least within the context of California real estate. In this scenario, a buyer purchased a home for under $1MM about ten years ago, only to see the value double over time. As shown, they had the opportunity to trade up to a $3MM property in 2021, with the difficult but conceivable option of paying $6,316 per month instead of $2,105. Today, the same buyer considering the same upgrade would have to pay nearly $10,000 per month for a similar upgrade.

Even if the affordability problem illustrated in the above example can be overcome by career advancement, a dual income family, or a tight labor market, the psychological barrier remains. Today’s potential move-up buyers know how much less they would have had to pay if they had upgraded a couple years ago. That is a tough pill to swallow.

With many potential move-up buyers facing these monetary and psychological issues, a large percentage are choosing to stay put. The result is not only fewer buyers in the market, but also fewer homes listed for sale as these buyers staying on the sidelines are also choosing not to sell their existing home. This goes a long way toward explaining our current odd combination of market conditions: low number of sales, surprisingly tight inventory conditions, and stubbornly high prices. If it is any consolation, today’s interest rates are still very low by historic standard. However, that doesn’t make the prospect of a $10,000 per month mortgage sound any easier!

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.