2023 was an expensive year to buy a home. In our November Spotlight, we discussed the high rate of homeownership today and how the cost of buying versus renting is at its most extreme since at least 1996. In this month’s Spotlight, we explore what this looks like through the lens of the median sale price for homes sold across the country. While purchase price isn’t the only factor involved in the cost of home ownership, it is the most important.

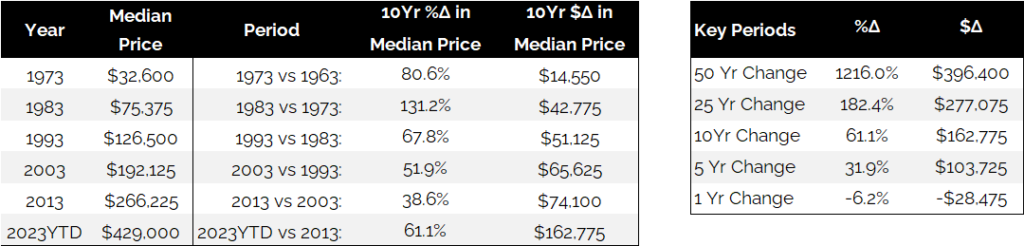

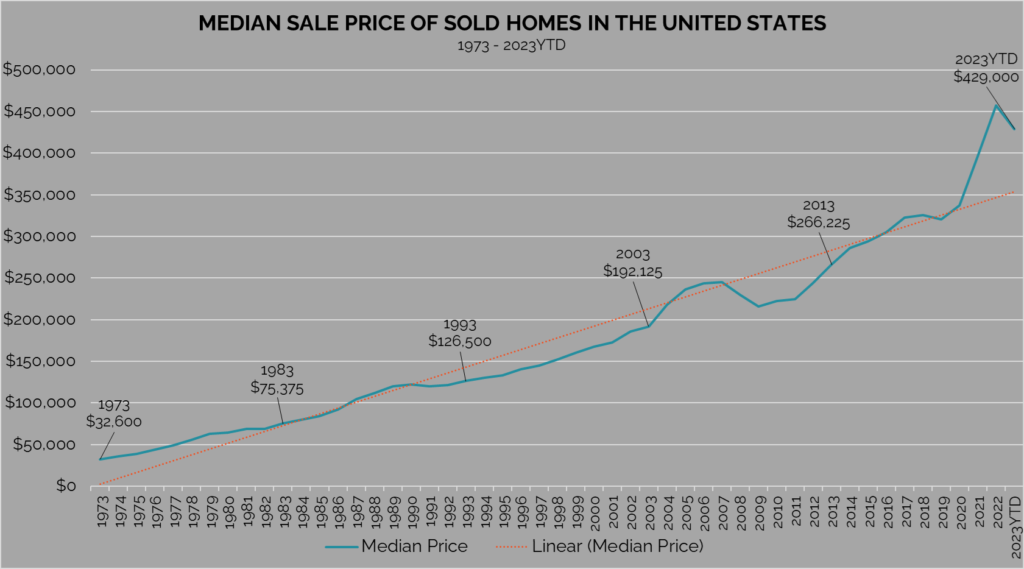

In 2023, the median sale price for homes sold in the United States was $429,000. While this is slightly lower (6.2%) than a year ago, it is significantly higher than even five years ago (31.9%). The ten-year period between 2013 and 2023 recorded a 61.1% increase in median home sale price (+$162,775 in dollar terms). This was the highest ten-year dollar change of the last half century with prices having broadly trended upward consistently over the last fifty years.

The recent rise in the median price of homes can be attributed to a confluence of factors, but most importantly tight supply. Since the Covid-19 pandemic, inventory conditions have been low in many markets, especially for single- family homes. The period between mid-2020 and early 2022 saw record low mortgage rates and shifting buyer preferences which drove up demand and in turn prices. Since then, 30-year fixed rate mortgages have shot up significantly, averaging 6.8% during 2023. Although this tempered home buying demand, via affordability constraints, it has also affected the pace at which new homes come on the market. Many homeowners, not wanting to give up favorable rates locked in during the pandemic boom, did not list their homes this year. This ‘golden handcuff’ phenomenon led to low inventory conditions and continued price appreciation throughout 2023 despite less overall demand for homes. In conjunction with high mortgage rates, 2023 became an incredibly expensive year to buy a home.

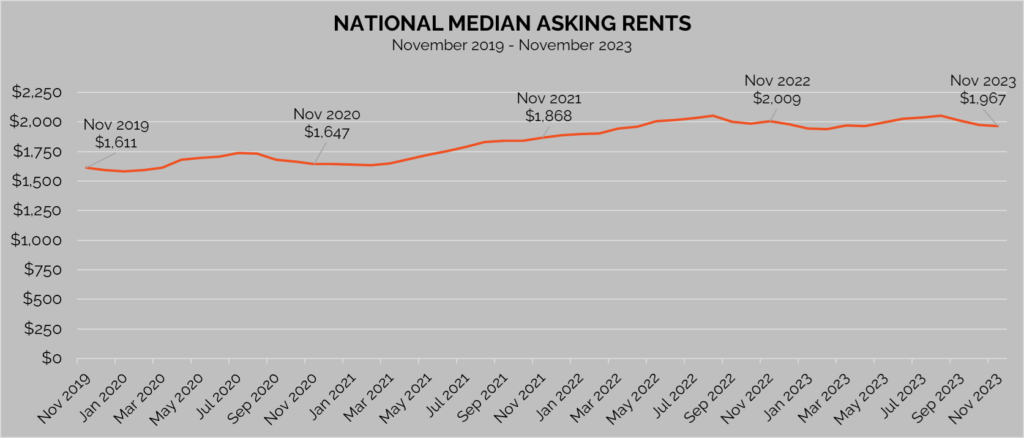

Many would-be home buyers in 2023, particularly those looking for financing options, remained put or turned to the rental market for housing. The table below illustrates the trend in the national median asking rents. Compared to pre- pandemic levels (Nov 2019), asking rents today are only 22% higher. While this is still a double-digit gain, it is more muted than home price appreciation over the same period.

As we close out the year, one stand-out theme across many real estate markets is the continued trend of rising home prices, or more specifically the cost of home ownership. While various factors go into determining home prices, the most recent surge over the last few years has been fueled by tight supply and shifting mortgage rate landscape.

Looking ahead, mortgage rates are not expected to further increase during 2024, marking a shift from the surge witnessed during 2023. While pent-up demand and low supply will likely prop up prices in some markets, the expected reversal in the movement of mortagae rates brings a promising outlook for prospective homebuyers, offering a potential respite from the elevated cost of home ownership experienced throughout the past year.

Sources:

Ryan, Carol. n.d. “There’s Never Been a Worse Time to Buy instead of Rent.” WSJ.

U.S. Census Bureau and U.S. Department of Housing and Urban Development, Median Sales Price of Houses Sold for the United States [MSPUS]

Sources: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US]

Rent.com December 2023 Housing Report

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.