The once-hot Covid-era housing boom characterized by record fast home sales and price appreciation came to an end in 2022. In its heyday, headlines around the country screamed red hot for the better part of nearly three years; however, a closer look at new construction attached product paints a more complicated picture beyond headline figures. While single-family home sales undoubtedly boomed across the country, buoyed by pandemic related shifts in buyer preferences and record low interest rates, condos did not always follow the wave.

In our first Spotlight installment of 2023, we explored attached new construction home sales in key, urban markets across the country. Because month-to-month contract sales can sometimes be volatile due to data collection and publication methodology, we looked at the annualized average monthly absorption over the last five years.

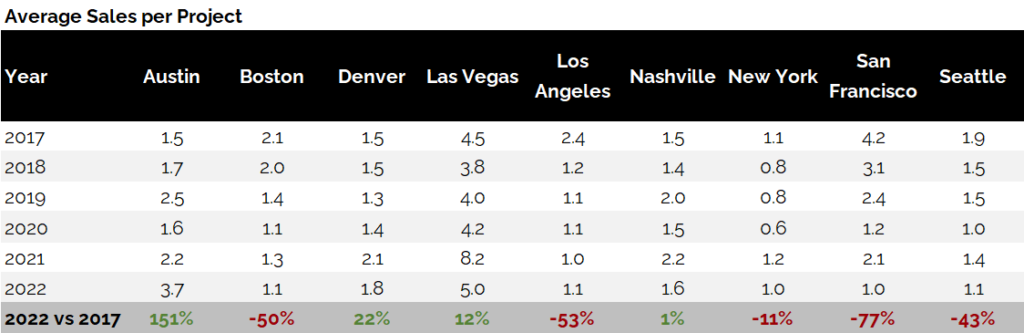

The table on the previous page summarizes the average number of sales per project in the key urban markets tracked. Austin, Denver, Las Vegas, and Nashville all saw a minor to strong uptick in new construction absorption for attached product compared to five years ago. On the other hand, Boston, Los Angeles, New York, San Francisco, and Seattle saw a downturn. A common theme between the four markets who recorded stronger new construction absorption is that they were some of the hottest real estate markets in the country during the Covid-era boom. They are all also markets that saw substantial urban development and revitalization, and were dubbed as “up-and-coming” markets, prior to the pandemic.

Meanwhile the five markets that recorded a downturn were broadly considered long-standing, well established urban markets. These cities had robust commercial centers before the pandemic. All had recorded a significant downturn in 2020 as office closures and pandemic induced changes in buyer preferences away from urban, compact attached product toward more suburban and expansive homes weighed on demand.

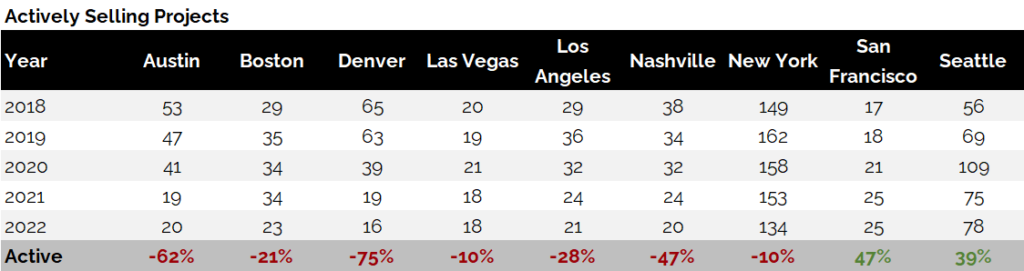

Looking ahead, with the exception of San Francisco and Seattle, the number of active new construction projects has decreased compared to five years ago, as evidenced in the table above. Developers with new, built product in cities who have seen a slowdown in new construction sales should weigh the advantages of price reductions and/or incentives alongside absorption targets, which may need to decrease if prices remain static. Meanwhile developers with projects in the pipeline should balance absorption and price expectations in light of elevated construction and rising financing costs heading into 2023.

In terms of whether and to what extent demand for attached product will return and/or remain strong depends on the specific market in question. For mature markets such as San Francisco, it will likely depend in large part on office occupancy given the high concentration of new product in the downtown (SoMa) area. On the other hand, the once up- and-coming markets will likely rely on continued population growth, urbanization, and favorable interest rates.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.