Negotiations are often a major part of the home buying and selling process. Whether homes are selling above or below ask, brokers, sellers, and buyers are often faced with the challenge of determining the right price for a home. In this month’s Spotlight, we analyze negotiability via the listing discount for Los Angeles’ ‘prime’ condominium market, an area that comprises twenty-six MLS districts from East Los Angeles to the beaches of Malibu.

Over the last five years, the condominium market in Los Angeles has experienced periods of booms and contractions. The initial onset of the Covid-19 pandemic and subsequent shifts in demand towards less dense housing and more space was a big hit to condo sales. By the summer of 2020, however, some demand returned, and by Spring 2021, the market was hitting five-year highs in sales volume. Since then, sales activity has fallen and today, the market stands at about the same level of sales as five years ago (November 2023 vs November 2018).

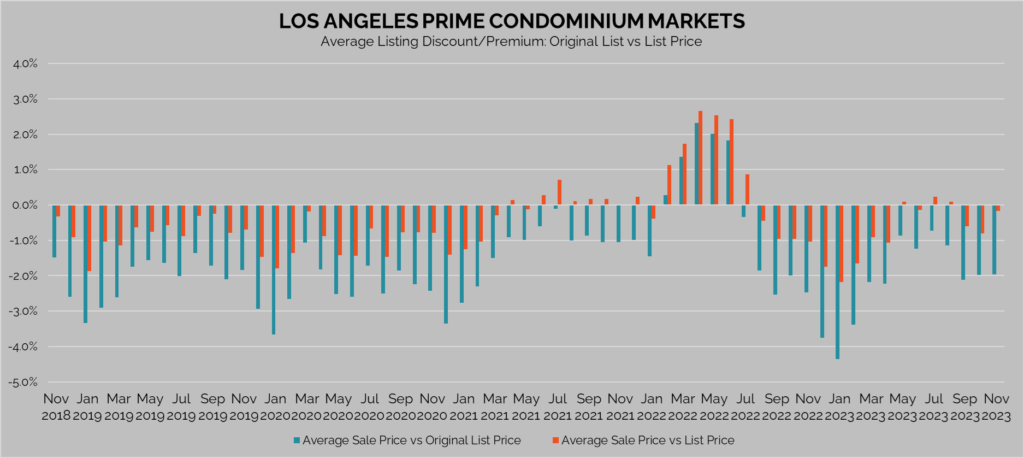

Throughout this time, negotiations—whether between sellers and their brokers internally or externally with buyers—have been at play. The five-year average difference between the sale price of a condominium in Los Angeles and the original list price is a 1.4% discount. If we look at the sale price versus the listed price right before the sale, however, it is only a 0.2% discount. This suggests that, on average, over the last five years seller discounts (a negotiation between a broker and seller) have played a larger role than negotiations between a buyer and seller.

Nevertheless, both forms have been present for the last five years. The table below illustrates the average monthly discount between the sale price and the original list price (blue bars), as well as the list price right before it sold (orange bars). We can see that between the end of 2018 and 2020, homes sold, on average, below their original and most recent list price. Spring 2021 marked a decisive shift toward premiums with homes selling above their list price. This was a story that often-headlined real estate news during this period. A closer look, however, reveals that while many of the homes sold above list, up until 2022 they were still selling at a discount to their original list price.

By February 2022, however, bidding wars escalated to the point where homes sold at a few percent premium to both their list and original list price. This overbidding period ended by the end of the summer and since then, prices have broadly returned to a discount from the original list price with negotiations largely favoring buyers despite some premiums paid over the most recent list price.

The back-and-forth shift in the kinds of negotiations at play are symbolic of how the real estate market was performing during each period. During contraction times, sellers will often be pushed to lower list prices, particularly if the unit lags on the market, to generate traffic. On the other hand, during booms, high demand and low supply drive up prices as units receive multiple offers and a bidding war ensues. While the latter was more muted for the condominium market in general, as compared to the single-family home market, many buyers during this time were eager to lock in still favorable mortgage rates.

*Prime markets include: Bel Air – Holmby Hills, Beverly Center-Miracle Mile, Beverly Hills, Beverlywood Vicinity, Brentwood, Culver City, Downtown L.A., Hancock Park-Wilshire, Hollywood, Hollywood Hills East, Los Feliz, Malibu, Malibu Beach, Marina del Rey, Mid-Wilshire, Pacific Palisades, Palms – Mar Vista, Playa Vista, Santa Monica, Silver Lake – Echo Park, Sunset Strip – Hollywood Hills West, Venice, West Hollywood Vicinity, West L.A., Westwood – Century City

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.