Inflation has dominated news headlines for much of the year. From the prices of food at the supermarket to gasoline, and housing, Americans are feeling the increase across a broad range of goods and services. The Consumer Price Index (CPI), a key barometer for measuring inflation, stood 7.7% higher in October 2022—the most recent month for which data is available—compared to a year earlier. Although this is the smallest increase since the start of the year—inflation peaked at 9.1% in June—it is still rising at a historically fast pace. The rapid increase can be attributed to a variety of causes including supply-chain disruptions, Russia’s invasion of Ukraine, the shortage of truck drivers and warehouse space, and a smaller labor force among other factors.

The housing market has seen record high home price appreciation since mid-2020. While the pandemic exacerbated existing supply issues—the price of key commodities such as lumber skyrocketed and the labor force dwindled, increasing construction costs—there have been long-standing issues affecting housing supply such as local zoning restrictions. Furthermore, increased mobility via remote work—and the resulting shift in home buying preferences—along with record low mortgage rates during the pandemic fueled home demand. This resulted in bidding wars and double-digit price hikes becoming commonplace in markets across the country through much of the latter half of 2020 and 2021. Although home prices are showing signs of cooling in many markets in recent months, they continue to outpace inflation.

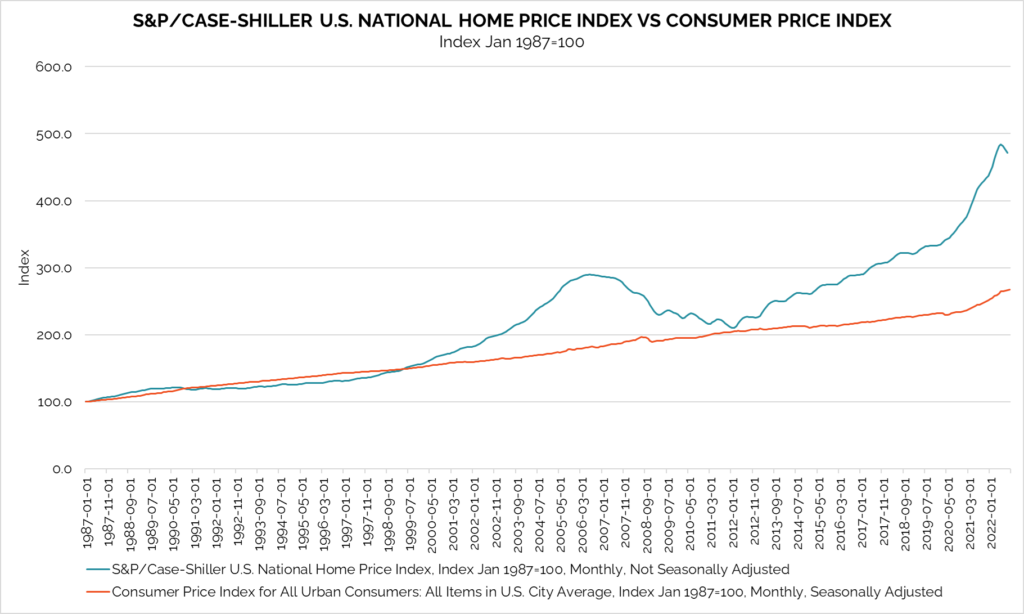

What does this mean for prospective home buyers, investors, and developers? A look at the historical movement of the S&P Case-Shiller Index and the CPI shows that for the better part of the last three plus decades national home price appreciation has outpaced inflation.

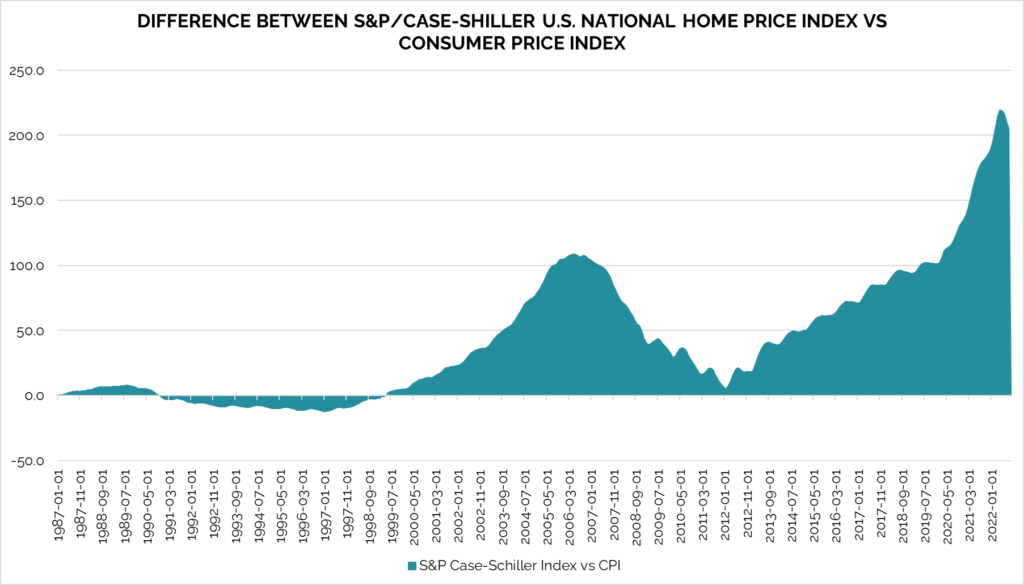

The exception was the 1990s, during which the real estate market experienced the hangover following the bust of the 1980s real estate bubble. The chart below depicts the difference between the S&P Case-Shiller Index and the CPI, highlighting in a clear way both the anomaly period during which inflation outpaced home price appreciation (negative region) and the otherwise long-standing trend of home price growth outpacing general inflation.

The 1980s saw a substantial run up in real estate prices, followed by a bust and lagging home price appreciation relative to inflation until the latter half of the decade which saw a moderate uptick. By the close of the 1990s, home prices were once again outpacing inflation—a trend that has persisted throughout the last twenty-two years.

Looking ahead, we expect the trend to continue. Housing has historically and consistently been a hedge against inflation—sheltering capital both during high inflationary periods but also more generally as property values steadily increase over the long term.

While pandemic-era demand factors have largely eased, longer-term structural issues in housing supply, which predate the pandemic, remain. Furthermore, affordability constraints will likely be a key issue in many markets. Nevertheless, the housing market remains healthy by historical standards—buoyed by strong demographic trends and mortgage underwriting standards compared to the early aughts. While we expect many markets to see a slowdown in home sales and price appreciation, home buying and building will continue to be a safe purchase and investment.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.