Last fall we began our series covering various types of mortgages and the impact of higher rates on the real estate market. In this month’s Spotlight, we check back in to see where rates stand, the impact they’ve had, and where the market could be headed in the future.

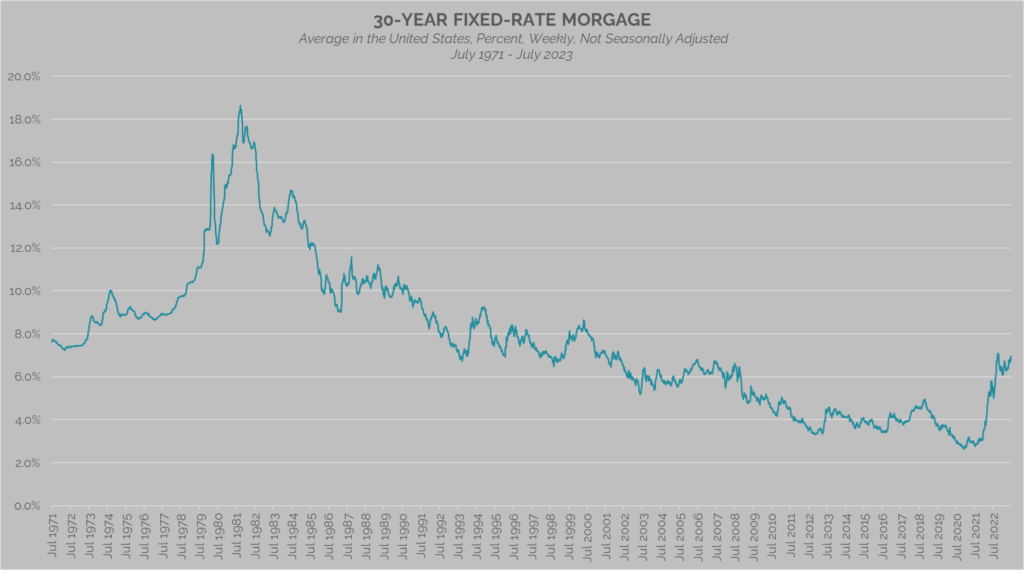

In the second week of July, rates hit their highest level, 7%, since November 2022 when they peaked at 7.1%—the highest seen in over twenty years. While rates fluctuate week-to-week, they had broadly been on a downward trend since peaking last Fall. Between the second and third week of July, rates did revert back to a downward trend, but they remain over a percent higher than a year ago and well above the record-low rates seen in 2020 and 2021. Nevertheless, by historical standards, even at 7% rates are still much lower than their historical peak which topped 18% in the early 1980s. It is important to note; however, that relativity is important, and many buyers today are focused on what their home financing costs are today versus had they bought a year or two earlier.

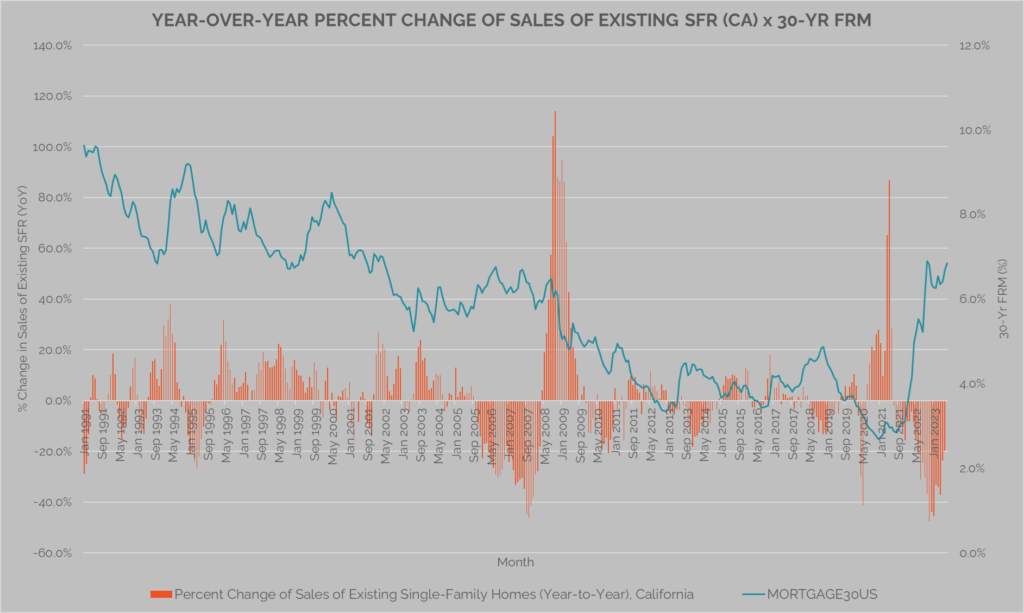

In our November 2022 Spotlight, we covered the relationship between the 30-year fixed rate mortgage and home sales. At the time, we predicted that while higher borrowing costs would weigh on home sales, the market is generally resilient in non-recessionary periods and that much of the expected slowdown would be the winding down of the pandemic-era housing boom toward balanced conditions. Furthermore, we argued that while mortgage rates are a key factor—a topic we covered in even greater detail in our April and June 2023 reports—they are one of many demand drivers. On the following page, we revisit a graph we looked at in November 2022 comparing the year-over-year percent change of existing single-family home sales in California versus the monthly average 30-year fixed-rate mortgage over the last thirty years. We can see that while there are instances where existing single- family home sales fell substantially from the previous year as rates rose—most recently over the last twelve months—the two do not display a strong correlation. Instead, while it is clear that higher mortgage rates, particularly when they increase rapidly (causing the lock-in effect or ‘golden handcuffs’ phenomenon), do weigh on home sales, there are many other factors that determine the performance of the housing market including broader economic conditions and demographic trends.

Looking ahead, while the housing market, particularly the existing home space, is expected to continue to see sluggish performance relative to recent years, there is great opportunity in the new home market. The lock-in effect, whereby buyers who locked in mortgage rates at 2% and 3% are reluctant to list their homes for sale and/or buy new property, has reduced the supply of homes and weighed down demand. There is, however, plenty of supply in the new home market that is not as acutely affected by mortgage rate fluctuations. Developers can capitalize on this to help boost home sales at their projects. One such way is by using creative incentives such as rate buydowns. Lifestyle demands and demographics, especially those impacting first-time homebuyers, will continue to buoy demand and there is great opportunity for new home developers to appeal to those who need to buy but are facing tight inventory conditions in the resale segment of the market.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.