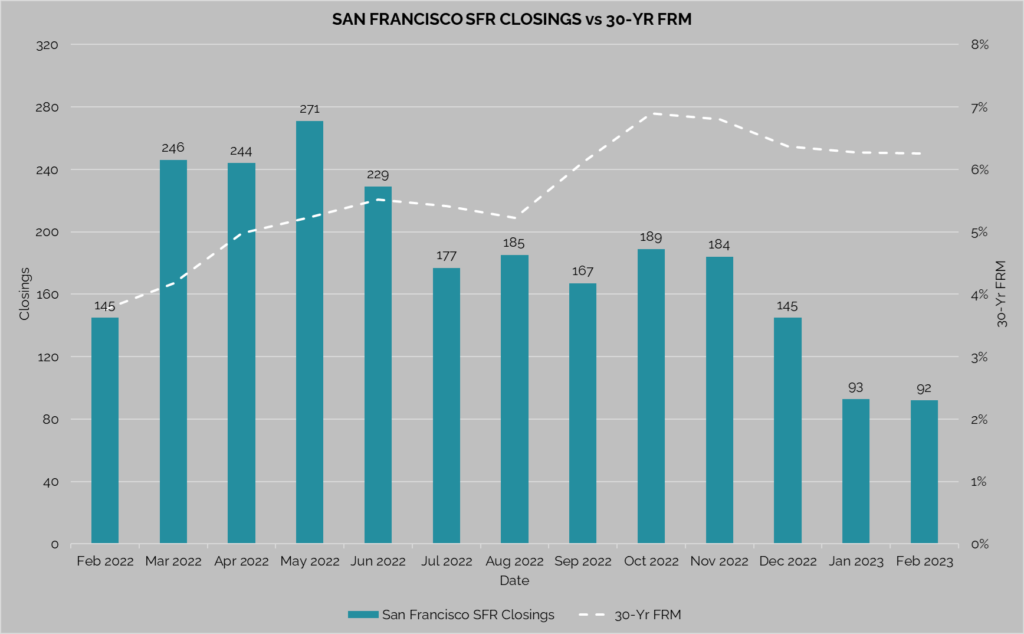

Over the last year, real estate markets across the country have recorded sharp downturns in home-buying, marking the end of the Covid-era housing boom. In 2022, mortgage rates rose sharply from 3.2% at the start of last year to their current rate of 6.3%. While they have come down since peaking in the autumn at 7.0%, and are low in historical terms, they are much higher than in 2020 and 2021 when they averaged 3.1% and 2.9%, respectively. In this month’s Spotlight, we will look at the trend in homebuying as well as the shift in the composition of homes sold at a local level with San Francisco as our focus.

In San Francisco, the real estate market slowdown has resulted in a 37% decrease in single-family home sales between February 2023 and the same month a year ago. While seasonal trends are back in play, we can see that aggregate home sale have trended downward as mortgage rates have increased.

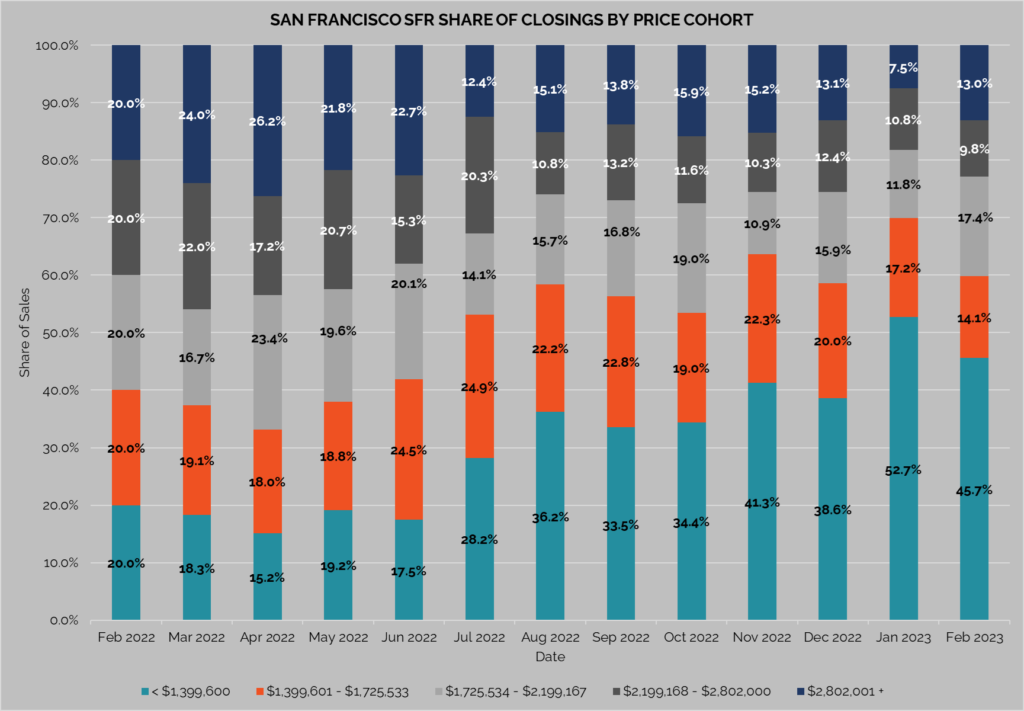

While this trend—higher home costs (reflected in higher mortgage rates and thus monthly payments)—results in fewer home sales, we took a closer look by analyzing the composition of homes sold between February 2022 and February 2023. The table on the following page shows the composition of single-family home sales by price cohort. The price ranges are split into quintiles using February 2022 as the base year. Each of the subsequent years uses the base quintiles determined in February 2022 and tracks the changes within that price cohort such that the least expensive quintile (homes priced under $1,399,600) increased from a 20% share of the market in February 2022 to a 45.7% share of the market in February 2023.

While we generally expect sales to slow as ownership costs increase, especially as rapidly as they did over the last year, we typically assume the lower end of the market will be hardest hit. That is, buyers who rely the most on mortgages to finance their home purchase will be the most susceptible to mortgage rate fluctuations. Instead, in San Francisco, we see the opposite to be true—the luxury segment was the hardest hit within the city. Despite there being more buyers in the luxury segment of the market who can finance a home purchase in cash, they are still susceptible to mortgage rate changes as well as broader changes in the market.

While San Francisco is not alone in seeing the luxury home market contract, it is perhaps one of the hardest hit. On a high level, many luxury home buyers were negatively impacted by volatility in financial markets, inflation, and general economic uncertainty and recession concerns. Buyers at this level also typically have more time: many of the homes purchased are secondary and tertiary properties, and therefore there isn’t a rush to buy or sell if market fears exist. San Francisco in particular was also acutely impacted by the high degree of volatility in the tech industry which has seen mass layoffs and devaluations. Many high-net-worth buyers coming from the tech sector also have a significant portion of their income tied to the stock market instead of solely a salary. Furthermore, with remote work becoming more prevalent and concerns regarding homelessness and crime on the rise, some buyers have fled the city.

On the other hand, buyers at the lower end of the market, while heavily impacted by mortgage rate increases, generally have less time when it comes to home buying. Many cannot afford to have money tied up in multiple properties and therefore have a higher degree of urgency when buying and selling. Furthermore, with headlines suggesting continued interest rate hikes ahead, many are hoping to lock in an approved rate before buying becomes even more expensive down the line.

Looking ahead, we expect aggregate home sales to continue to be lower than peak levels seen during the Covid housing boom. This is largely because a frenzied market is not sustainable long-term. At some point, it must cool off and normalize. Looking at the luxury segment, there are already signs suggesting home sales are picking back up since the start of the year. We expect home buying in general to pick up in the Spring as seasonal trends take effect.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.