From the TKG Archives: Revisiting Adaptive Reuse Developments

APRIL 2025

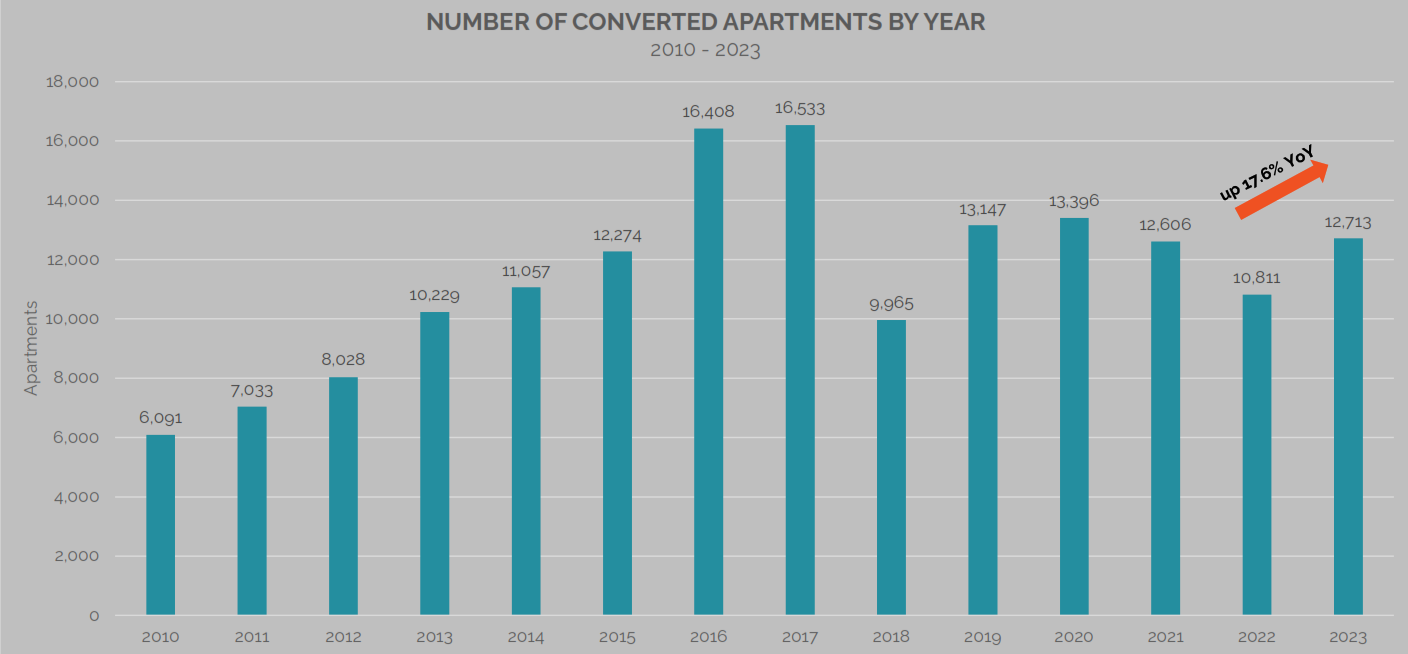

While still below the 15-year peak in 2017, conversions are on the rise and closer in line with pre-pandemic levels than in the previous year. However, despite persistently high office vacancy rates and stagnant office building values, hotel-to-apartment conversions are now more common than than office-to-apartment conversions.

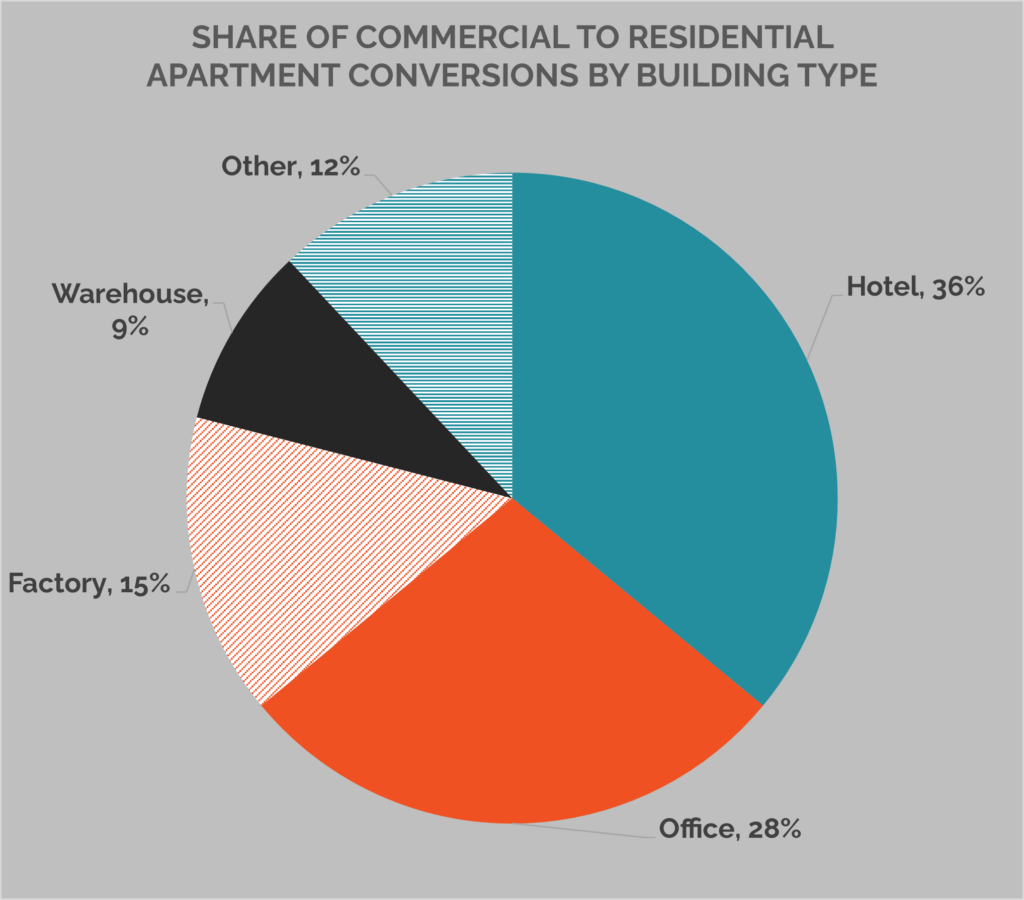

There are various types of commercial buildings that are adapted into housing. Historically office to housing conversions have been the most prominent, but in 2023 hotel conversions accounted for the largest share at 36%. The surge in the share of converted hotel units is in part due to a single project in Manhattan, FOUND Study Turtle Bay, in which the old New York Marriot East Side was renovated into a 655-unit student apartment project. Meanwhile, office conversions accounted for 28%, factories 15%, and warehouses 9%. Other building types, which can include schools, houses of worship, medical buildings, and retail spaces, accounted for a combined 12% of conversions in 2023.

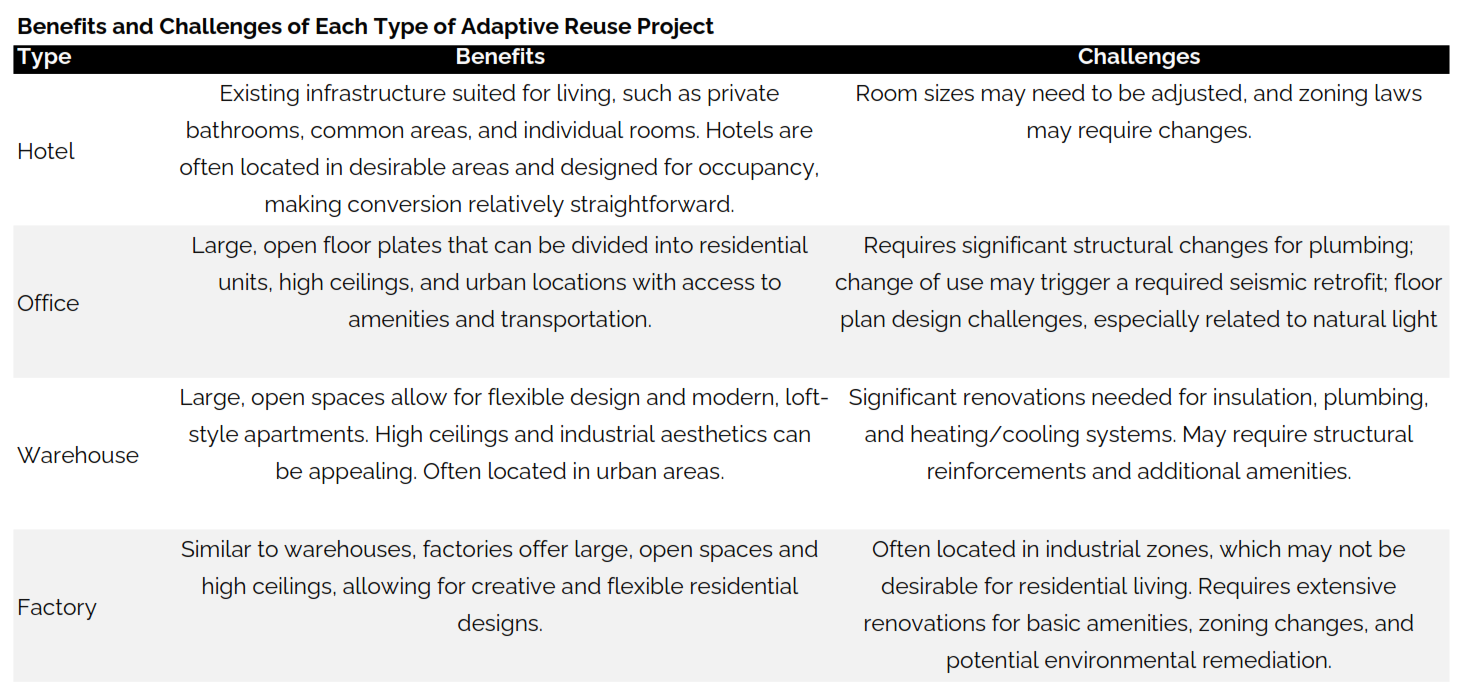

The suitability and ease of converting various types of commercial buildings to housing vary according to a variety of factors including the existing infrastructure, layout, and location. The table below details the benefits and challenges of the top building types used in adaptive reuse projects.

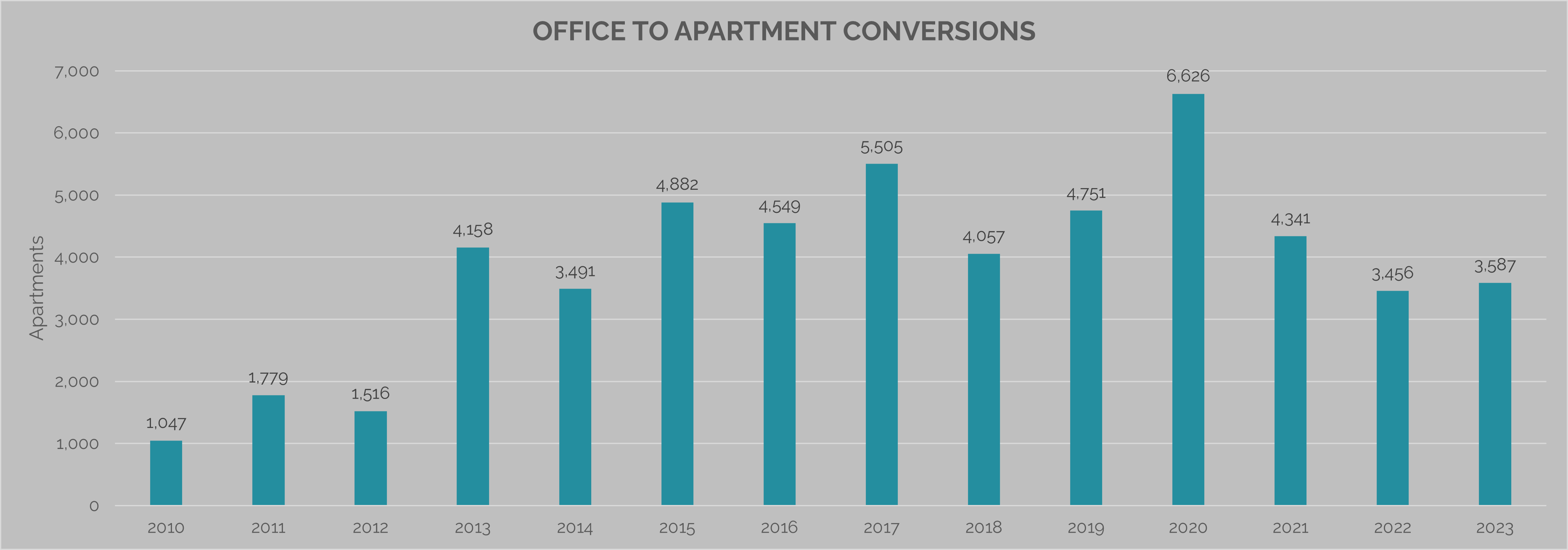

The continued move toward remote and hybrid work models coupled with the fact that as office leases expire many tenants move to smaller spaces in newer, often more amenititzed buildings, leaves an opportunity for developers to capitalize on the shifting commercial landscape and repurpose older commercial spaces. In Q1 2024, the national office vacancy rate hit a record high of 19.8%; some of the highest vacancies are in Detroit, San Francisco, Houston, Denver, and Seattle. The table below details the number of offices converted to apartments each year since 2010. Office conversions peaked in 2020 during the height of the pandemic and currently sit 3,587 apartments.

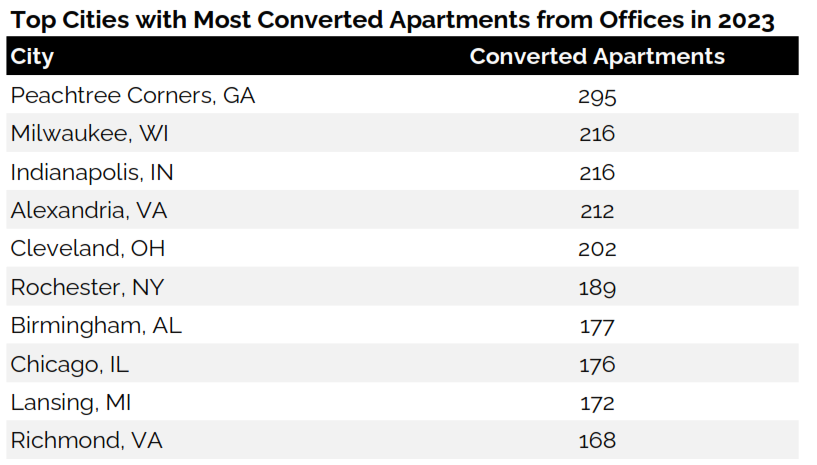

Meanwhile, the table below details the top cities with the most converted apartments from offices in 2023.

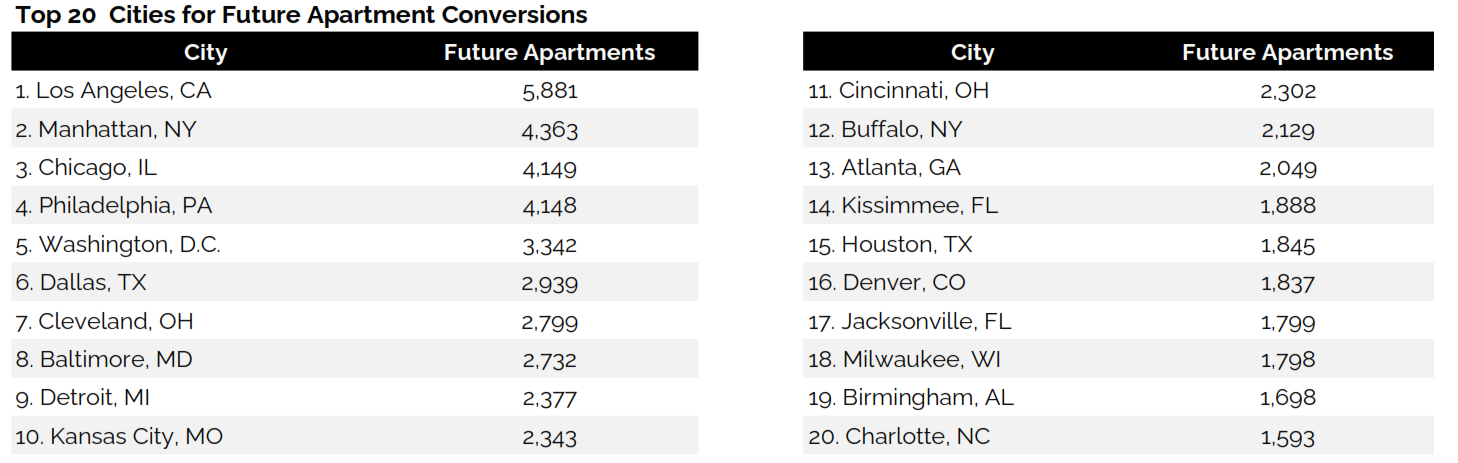

Looking ahead, there are 151,000 apartments currently in the adaptive reuse pipeline. Offices comprise the largest share of the pipeline, accounting for more than 58.000 future apartments (38%). The next two largest categories following office conversions are repurposed hotels (22.5%) and factory conversions (11.8%). The table below details the top 20 cities for future apartment conversions with Los Angeles, Manhattan, and Chicago leading the way.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.