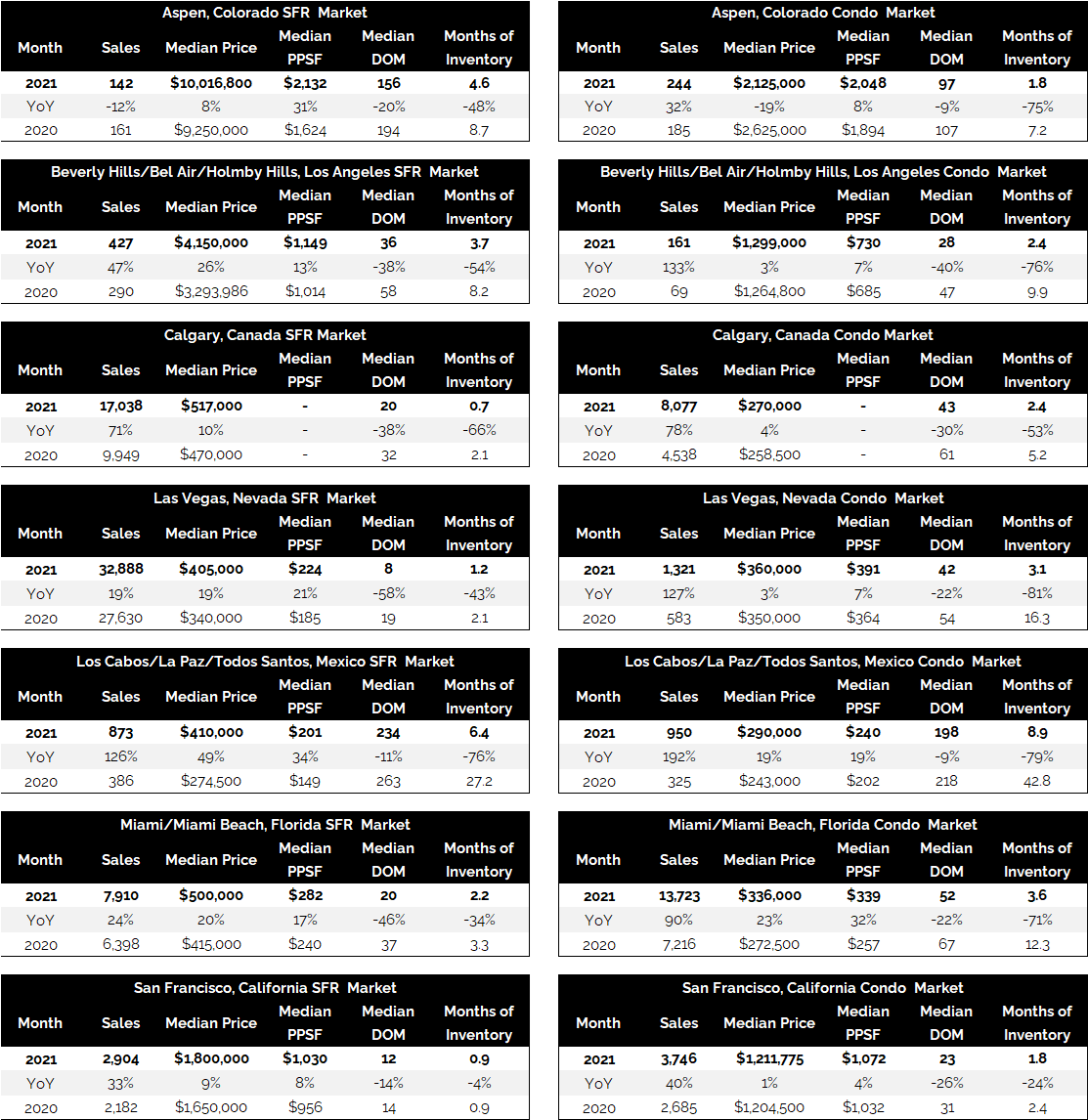

Housing markets across the continent experienced a record-breaking year in 2021. The Kennelly Group surveyed nearly 50 North American markets from as far north as Canada to the beaches of Mexico and both coasts of the US at the close of the year. We found a nearly universal theme across the board: record price growth and extremely low inventory.

Focusing on the national level in particular, the red-hot market can be attributed to a variety of factors including recession-induced low mortgage rates, demographic changes (largest cohort of first time, Millennial buyers), and the continuation of remote work from last year which helped spur demand in vacation destinations and exurbs. Given 2021’s housing frenzy, what will the market look like in 2022? On a national and international level, the projection for the new year is still uncertain; however, many markets have already shown signs of cooling with fewer bidding wars and a return to seasonality at the close of 2021. While the US housing will likely continue to favor sellers in the new year, some key factors to look out for are rising mortgage rates as the Fed responds to inflation and the end of pandemic-related stimulus, the effect of supply chain shortages on home building and new inventory, as well as whether offices will curb back remote and work-from-home policies.

In this report, we will highlight some of the most notable markets tracked in 2021.

All information is from sources deemed reliable but no guarantee is made as to its accuracy. All material presented herein is intended for informational purposes only and is subject to human errors, omissions, changes or withdrawals without notice.